Key facts

17,000+

employees

EUR 5.4 billion

sales for 2023

Close to 50 countries

with presence

Management

Pekka Vauramo is the CEO of Metso.

For our customers’ benefit

We deliver unique benefits to our customers with offering that combines equipment and services in aggregates and minerals processing. We offer digital and automated solutions and technologies that, in addition to being energy, carbon and water efficient, improve circularity and safety. We also have industry-leading service expertise and our extensive global service network is always close to the customer, improving availability of spare and wear parts. In addition, our strong innovation and R&D activities, and an uncompromising approach to safety also benefit our customers. At the core of our offering are the Planet Positive products that are more energy or water efficient than the benchmark technology or help our customers achieve their recyclability and other sustainability goals. This portfolio includes over 100 products, and we aim to have a Planet Positive product for every part of the customer’s value chain.

We understand our customer’s world and the daily challenges they face. Together, we can partner for positive change.

Working towards decarbonization

Sustainability is our strategic priority. We are one of the enablers of modern life and society: Working toward decarbonization and a safer working environment together with our customers, communities, suppliers and other partners.

The global energy transition requires minerals, and our customer industries’ energy- and water intensive processes have significant environmental footprints. Our customers must meet the growing minerals demand while managing decreasing ore grades and stricter sustainability requirements. That’s why we invent more sustainable ways to help our customers.

We must also take care of our own emissions footprint. We target net zero emissions by 2030: An ambitious target for which we have a strategic commitment and roadmaps. We work together with our suppliers and logistics chain to build more sustainable value chains. We also have zero-harm ambition. Preventing injuries applies to people, products and services. Safety is our utmost priority.

Read more about sustainability at Metso.

Reshaping the future

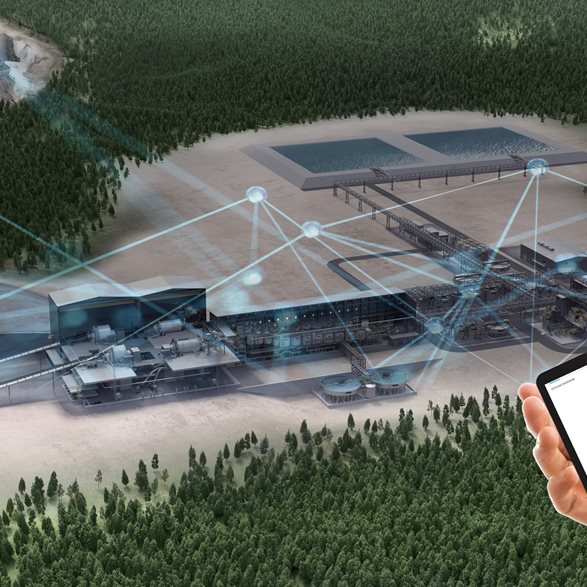

Our digital solutions keep our customers’ operations running smoothly and efficiently. With intelligent instruments and software solutions, our customers in the mining, aggregates and metals industries can get more out of their process with less, thus enabling more profitable, efficient and sustainable production.

In the field of digitalization, our strengths lie in understanding our customers’ business and data, and utilizing that knowledge to analyze, automate and optimize their processes and performance. We strive to improve the key performance indicators of our equipment and services, and at the same time minimize their operational costs and environmental footprints.