One major issue that has impacted most sites globally has been how mines can find the balance between maintaining high production to take advantage of current commodity prices while at the same time dealing with supply chain logistics and excessive lead times for equipment parts. Prices for spare and wear parts is another challenge, as producers look for alternatives when deliveries are squeezed.

Shocks to the supply chain

In some ways, it has been a perfect storm when it comes to global supply chains. With manufacturing sites cutting back on production during the early years of the pandemic, they were not prepared for the snap-back in demand that followed when business began to recover. Manufacturing sites and foundries that had temporarily closed or gone on minimum production did not have the capacity to keep up when orders began to flow back in for large castings and components.

The conflict in Europe further pressured supply, causing many large components for mining crushers, filters, and mills to double or in some cases triple their standard lead times, with some electronic parts simply not available. Backlogs developed at ports as containers waited to ship and delivery dates have often been pushed further and further out. A side issue facing many sites is the knowledge-gap created by skilled personnel leaving the workforce for retirement or other reasons. Some plants have struggled to replace highly skilled capacity and production planners which has led to parts supply issues becoming even more serious and difficult to manage.

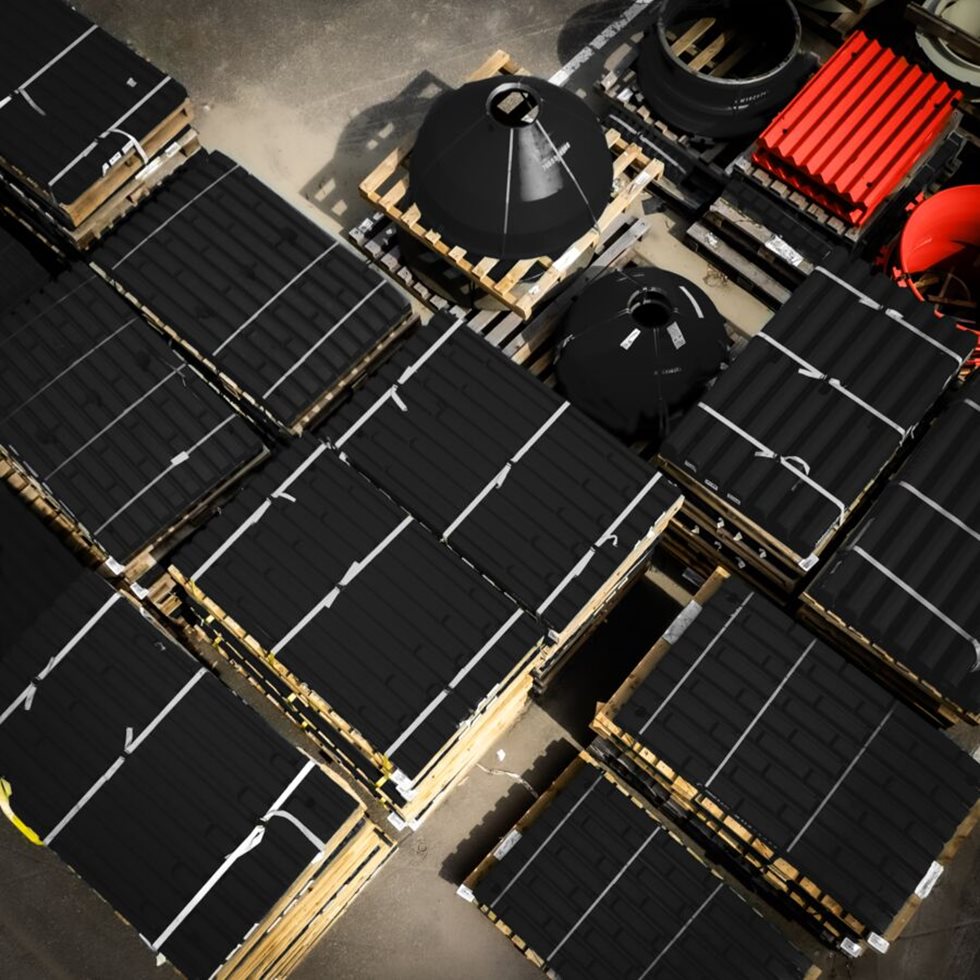

Mining producers have taken different approaches to mitigate supply challenges with mixed results. Some have opted to continue with transactional purchases while locking in prices under fixed price agreements, while others have made advance purchases to get ahead of the curve in terms of delivery. Some producers have looked to widen their supplier base, while another trend has seen a shift towards vendor owned inventory under long term contracts at customer sites. Each approach has advantages as well as points to be aware of before making decisions.