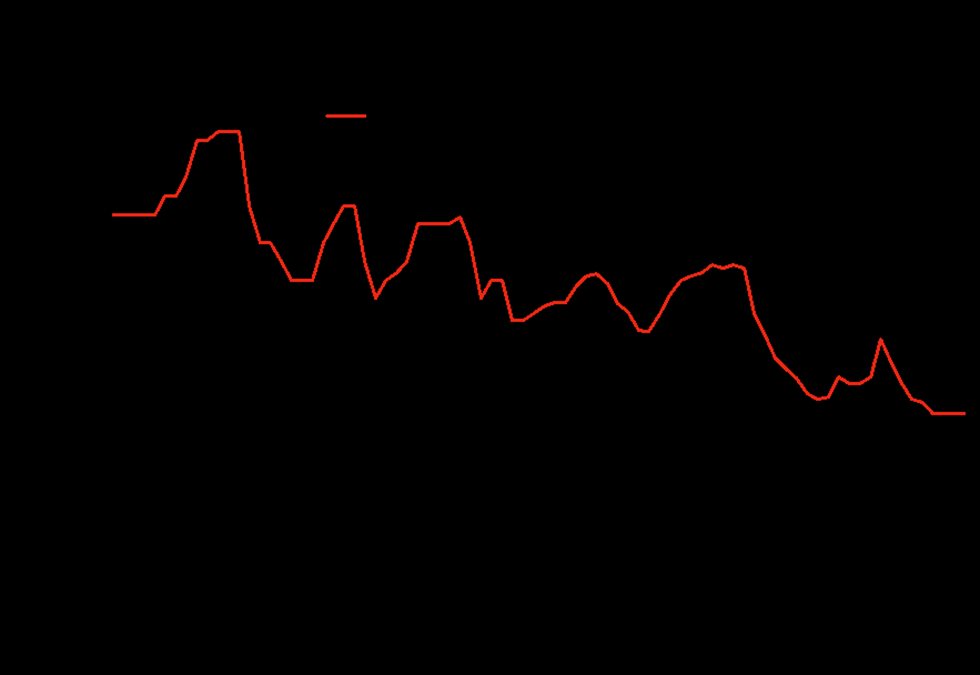

The COVID-19 pandemic has had a major impact on our global economic system, as well as on many businesses. The Mining industry has been severely affected, seeing high volatility in metals prices and disruptions in both supply and demand. Copper had seen more challenges during the first and second quarter, but since then has been supported by Chinese recovery and reactivation in its main industries that also drove the demand for metals.

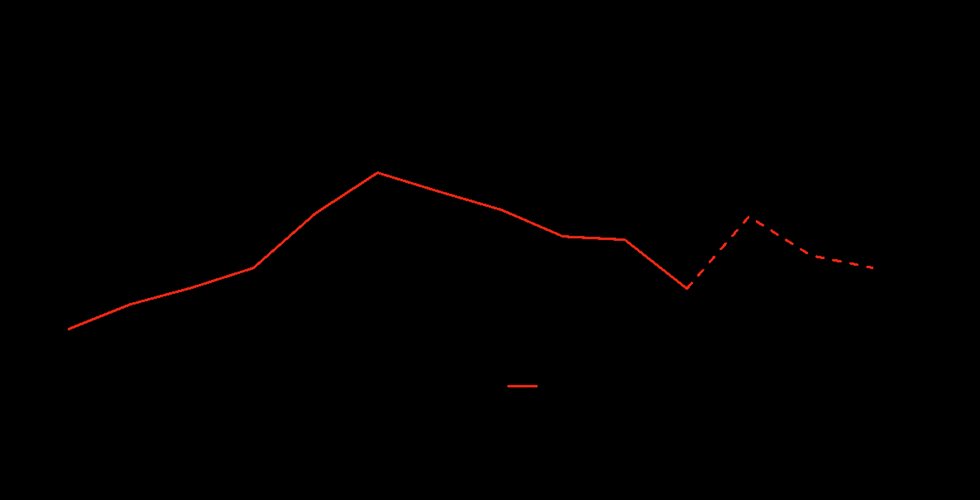

In 2020, copper treatment charges were decreasing to a multi-year low level reflecting low availability of copper concentrates. The supply of copper from mines in South America was hit hard by the pandemic, while imports into China, the world’s biggest copper consumer, were at record levels (+3% in H1 2020 vs H1 2019 according to Fastmarkets) as the country’s economy rebounded. Higher copper prices should provide an incentive for miners to maximize output next year. In 2021, treatment and refining charges are expected to recover, if no major disruptions occur to mining operations and hence to concentrate supply.

Global Supply & Demand

In the beginning of the year, the copper production had already been disrupted by COVID-19, with a high number of mines putting their operations partially or completely on hold. However, at the end of the second quarter, most of the miners resumed production. All in all, for 2020 the supply is expected to contract more than 2% compared with the previous year.

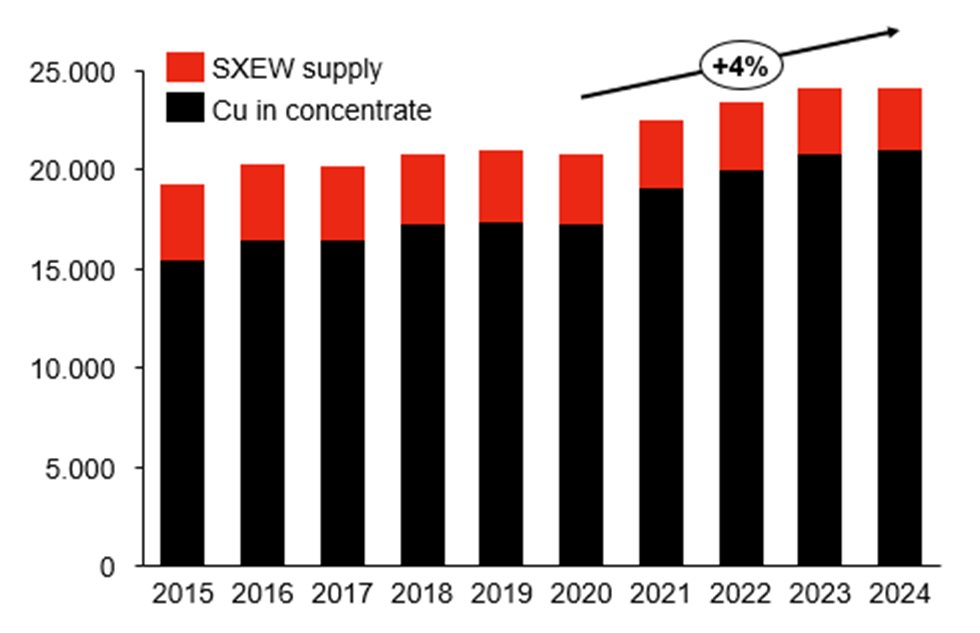

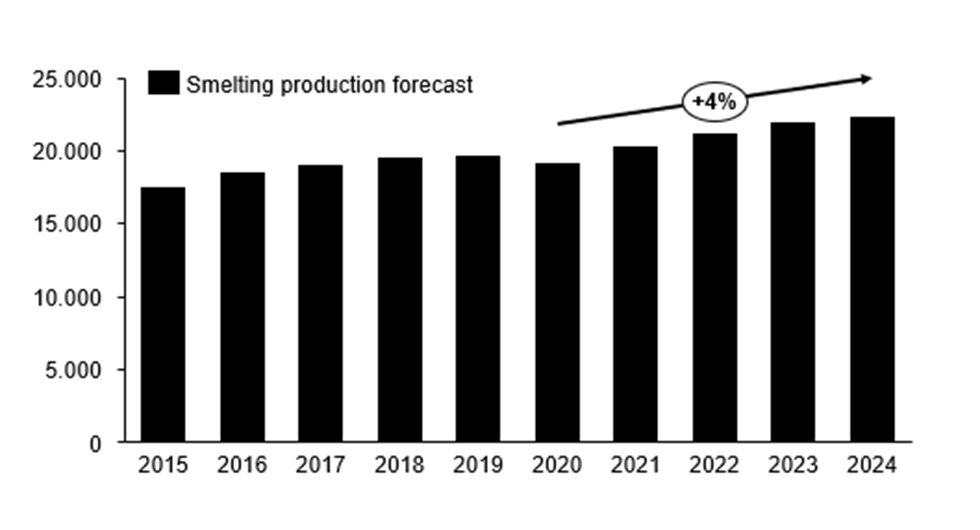

Despite no growth in 2020, copper committed concentrate is expected to grow at 3-4% CAGR between 2020 and 2024. With the assumption that not much more than 100 ktonnes will come from new concentrate projects and restarts, and a disruption allowance of approximately 900-1000 ktonnes per year, the total copper in concentrate supply is expected to grow by 2.9% per year, reaching above 20 000 ktonnes by 2024. In addition, SXEW (solvent extraction) supply is expected to add another 3000-3500 ktonnes per year to the total supply.

The supply growth has been supported by the recently committed projects and expansions including Grasberg, Cobre Panama, Quellaveco, Oyu Tolgoi, QB2, Spence.

Overall, the market is expecting to see the total amount of mined copper increase by 2.1% per year, reaching above 23 000 ktonnes by 2024.

Global demand for copper is expected to grow at 1.3% CAGR over the next five years. In short-term, the copper market balance is expected to turn into a surplus, though in order to reach the future demand, more investments are needed in expansions and new projects. The Chinese economic recovery in second half of 2020 has been faster than initially expected. Copper received support from the reactivation in manufacturing and construction sectors.

The environmental agenda and electrification are supporting demand for refined copper for use in electric vehicles, the growing share of renewable energy, and a reduction in copper scrap imports. Furthermore, the digitalization strategy "Made in China 2025" supports an increase in copper demand for use in robotics and industrial machinery applications. However, COVID-19 leads the recovery narrative and there is a risk of low economic activity and restriction in movement in case of a prolonged outbreak.

Total Mined Copper